Posted by: Cheryl Savit, Savvy Words for Kevin Cradock Builders, PR Committee Member

Despite challenges in 2020, the outlook for the remodeling industry looks stable and more positive than negative, according to Kermit Baker, Senior Research Fellow at the Joint Center for Housing Studies at Harvard University. Baker returned to offer insights into prospects for national and regional remodeling.

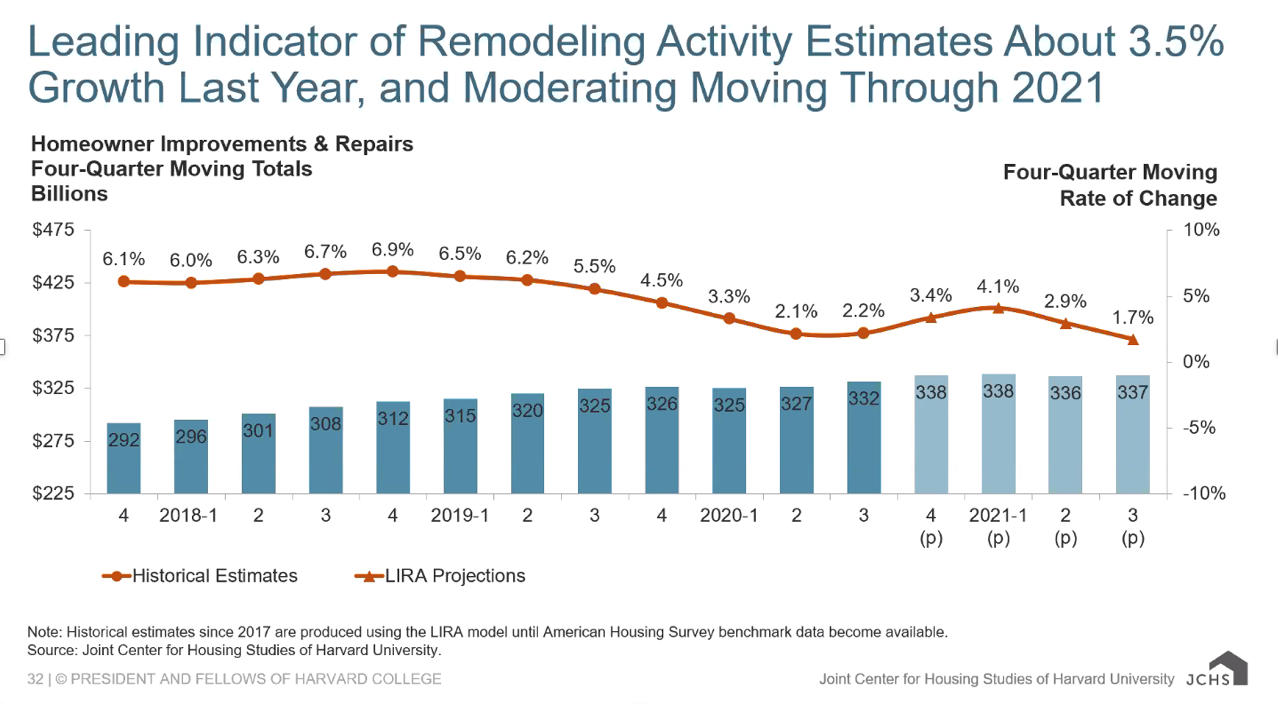

Overall, the remodeling industry experienced 3.5% growth and expectations are that 2021 will meet or exceed that benchmark.

Boston is seventh in the nation of top metro areas, spending 6 billion dollars, 1.5% above the national average. The good news is that our region has an aging housing stock, and the pandemic has created a backlog of work for home improvement projects, especially exterior ones.

On the other hand, remodelers are still in need of skilled workers. Further complications that resulted from the pandemic are the challenges in the supply chain, especially the availability and delivery of lumber.

Overall, the long-term forecast looks positive as Millennials purchase starter homes outside of the city, migrating to the suburbs and more rural areas. Their moves may have been accelerated by the pandemic, but the trend seems to be steady. Another benefit of the pandemic was the shift of discretionary spending from travel to residential projects. As several members pointed out, boomer parents are subsidizing many projects and there is more demand for multi-generational solutions like in-law suites, flexible spaces, and kitchen upgrades.

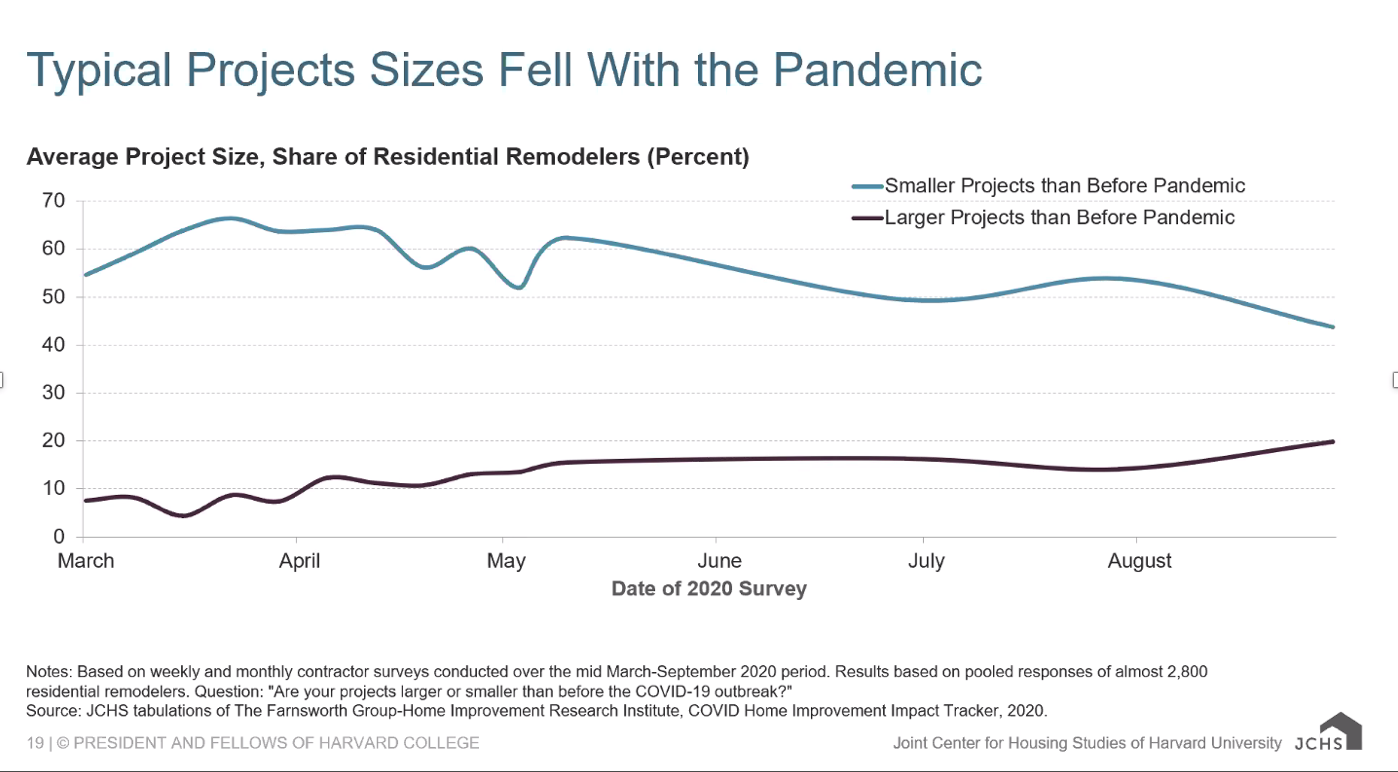

The demand for smaller projects was seen in 2020, but larger projects (>$50K) are coming back.

Two factors will impact the future of remodeling:

1) Converting retail and commercial spaces to residential housing. Households will live in different kinds of places. (Think: how old schools were converted into housing when the population shrank) Opportunity knocks!

2) Home design decisions will shift. In the boom before 2007/2008, discretionary projects were home theaters, exercise rooms, and wine cellars. Now demand is for mudrooms, home offices, and outdoor spaces.

Another area of opportunity for remodelers is in the rental market for structural improvements. Although the rental market was harder hit by the pandemic than single-family homes, Baker foresees a rebound as jobs return and the pandemic subsides. More than 52 million Americans experienced job loss during the pandemic. Furthermore, lower-income households suffered more because of the pandemic and have the most difficulty because their properties (rented or owned) typically need larger repairs.

MAJOR TAKEAWAYS FROM MEMBERS

Roger Gallagher said he was reassured by the demographic migration data. “Happy to hear that people are content to spread out to the suburbs,” he said.

Cathy Follett pointed to the pattern of more, smaller projects and said that her firm has “received inquiries that are a mix of multiple projects.”

Eric Adams takeaway was that the “forecast seems to be stable going into 2021 and should be good for us.” Bill Farnsworth agreed that members are busy and are going to be even busier in 2021 and suggested that raising prices–not only covering rising labor costs – might not be a bad idea to compensate for the supply and demand issues.

Von Salmi’s found the position of Boston in the statistics to be enlightening, noting that half a dozen markets exceed Boston in expenditures, belying the common belief that Boston is one of the most expensive cities in the U.S.

To see the entire presentation and discussion, watch the Video here.