Posted by Cheryl Savit, Kevin Cradock Builders and EM NARI PR Committee

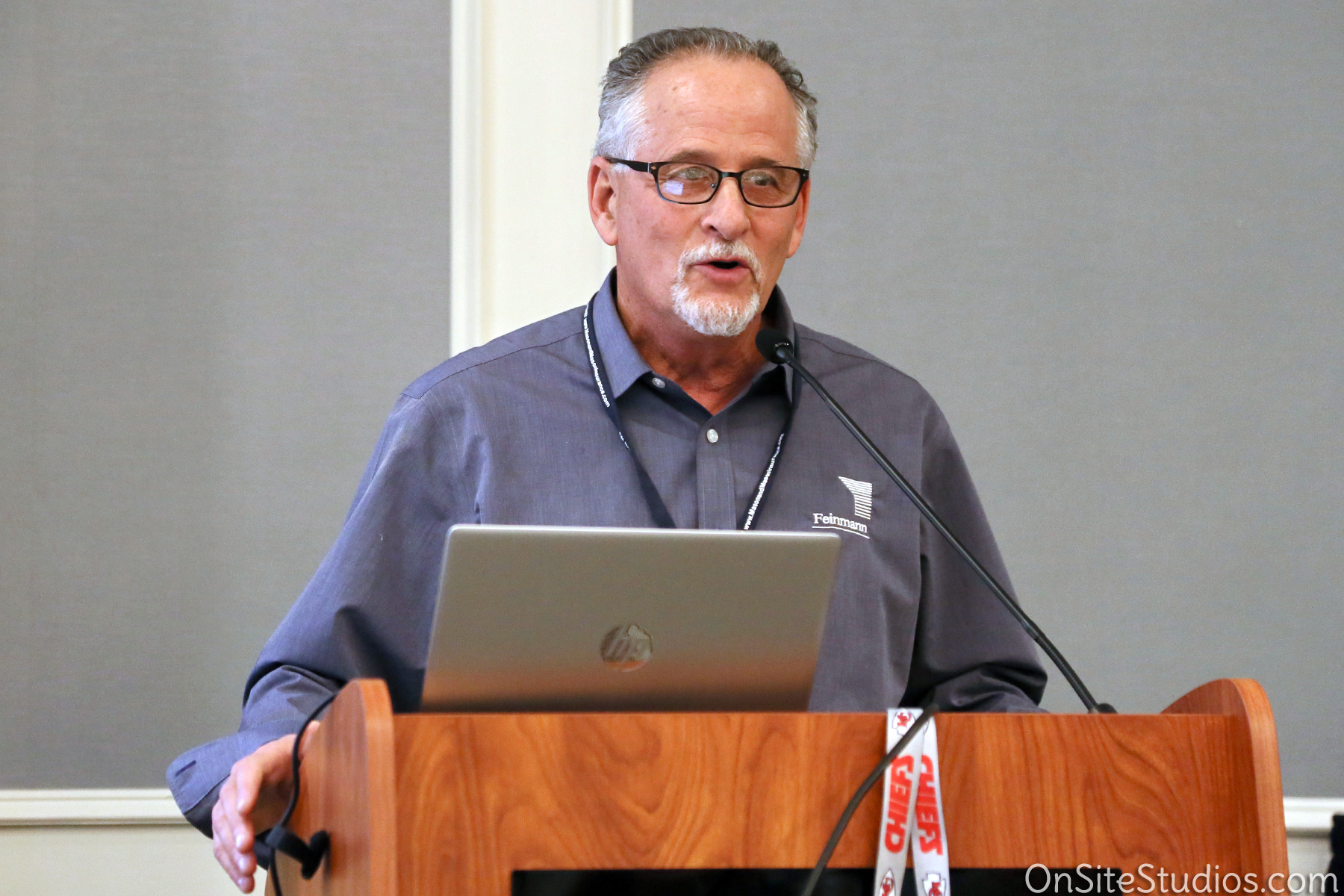

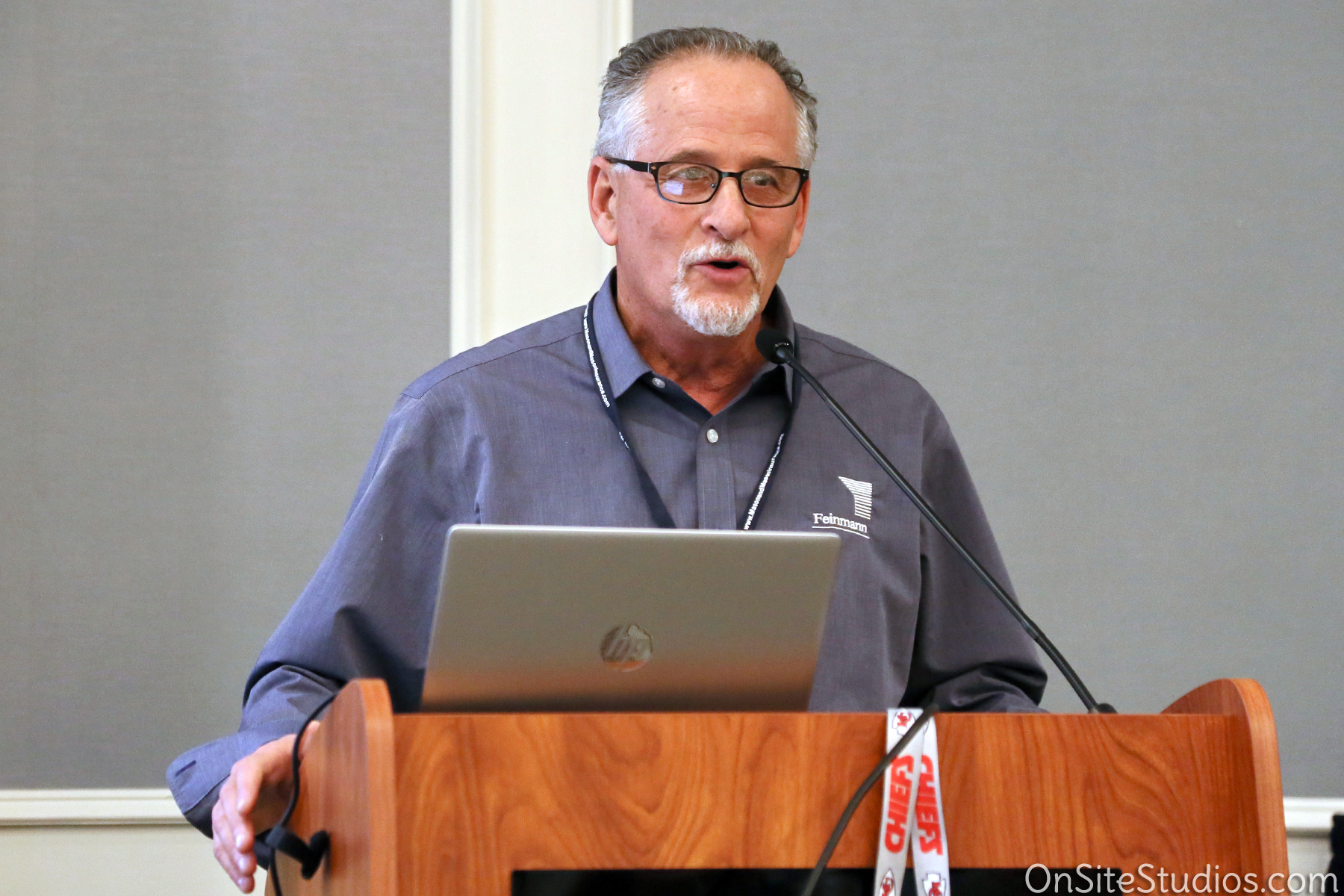

Chris Kuehl, Co-Founder and Managing Director of Armada Corporate Intelligence, presented the annual economic forecast for EM NARI. There was good news and bad news, but overall the 2020 forecast looks positive for New England.

Kuehl analyzes two metrics across all business sectors: the Credit Managers Index (CMI) and the Purchasing Managers Index (PMI). The good news is that the CMI appears strong. Overall, Kuehl predicts business growth at 2%.

Another bit of mixed news: machine tool makers are receiving orders, but delivery is delayed. While the unemployment rate remains low, the building industry is at the epicenter of labor challenges. Combined with an aging workforce and fewer people entering the trades, New England building and remodeling business owners need to sweeten the pot to retain great workers.

Other positive signs:

- The quit rate is the highest it has been in 3 decades at 5% (the number of people who quit with no job lined up)

- The average time that the average worker is unemployed is two weeks

- The Phillips Curve is not following a predictable pattern. In this curve, the usual drop in unemployment rates causes an increase in wages and eventually inflation, leading to a slow down leading to a recession. However, this isn’t happening

- Interest rates remain historically low

- Consumer confidence is high (holiday spending – while not the highest – was less terrible than predicted)

- Tariffs have not caused terrible inflation leading to reduced worry about inflation from commodities

- As Baby Boomers retire and leave the workforce, they are replaced with people at lower salaries/wages. This may partly help us to understand why the Phillips curve is not predictable

Some more bad news:

- Wage growth is stagnant

- Most growth is in low paying jobs in the service sector

- Fewer well-qualified candidates for jobs

- Debt is overwhelmingly large

- A political election can leave people feeling less confident

- Further trade war concerns may make economy jittery

- Impact of global slowdowns, especially in Europe and China

Impact on Remodeling Industry

Millennials have been slow to purchase single-family homes and not as enthusiastic about the suburbs. GenZers like Uber, don’t drive and want to live where there is easily accessible technology. Couple that with rising labor costs and some Millennials are priced out of the market altogether. On the other hand, Boomers seem reluctant to leave their homes and have the money to invest in them. Retrofits for aging in place will be popular in areas with older home stock like Boston (New York, Miami, Chicago, Phoenix, and more).

The best news of all is that Boston is home to healthy business sectors: healthcare, high tech, and manufacturing. One indicator to watch for the future is the rise of technology – robotics specifically. How things are made and built will become a compelling story in the next decade – artisan vs. automation.

Kuehl offers several free reports and the Black Owl Report for $84. His company also offers an e-newsletter, the Business Intelligence Brief. For more information or to subscribe, visit www.armada-intel.com. Chris Kuehl can be reached at ckuehl@armadaci.com

Additional Meeting News

- Chris Manley from Resource Options Inc., luncheon sponsor, welcomed everyone to the meeting and spoke briefly about how ROI can assist EM NARI members

- Michelle Glassburn made announcements:

-

- 2020 EM NARI CotY Awards accepting submissions through February 7

- Annual Remodelers Conference will take place on February 7th at the Best Western Royal Plaza & Trade Hotel in Marlboro