Posted by Michelle Glassburn, Executive Director of EM NARI

NARI Webinar – April 1, 2020

Presented by Chris Kuehl, Armada Intelligence

We are dealing with an “unexpected expected event.”

Overview:

Many areas of economic distress we were already experiencing – this just made it worse. Markets were already volatile. The COVID-19 pandemic gave a reason for the markets to reset. The supply chains were shattered – especially out of Asia. That is starting to rebound.

PMI – Purchasing Managers Index. It is a survey and it is current. By and large, it isn’t as “subject to influence.” You can track purchasing and get a sense of how the economy is doing. Anything over 50 is expansion; anything under is contraction. China dropped to 40 a year ago – severe contraction. They have rebounded quickly and are now at 55, and back to expansion.

We are in a recession – an “imposed recession” — which is different than 2008. This has been a deliberate, forced recession. This suggests that we can force a return to normal. Banks have done all they can with rates and liquidity. They are flooding the economy with money – unfortunately, there is nowhere to spend it. (Other than toilet paper.) It seems that once restrictions are lifted, we can quickly return to normal.

South Korea did things differently. They tested all first responders. Then, they tested the most vulnerable. They followed by quickly isolating people who were infected. They went into the social shut down aggressively – although not the complete closing of all business as is being done elsewhere. South Korea is unique as a culture because they are always threat-ready. So, when the government says they are being “invaded” by a virus, the people respond. They are still trying to shut the borders more effectively though.

Key Notes:

- Around 70% of people have some level of concern about the situation.

- The markets dipped severely in reaction; they continue to be volatile.

- This situation is not the worst we have seen. We do not believe this will linger. This will be more like 9/11.

- This is not the first time the Fed has taken dramatic steps. They acted around 9/11, the tech bubble, the 2008 financial crisis, etc.

- Credit Managers Index. The decline has been in favorable factors (i.e. sales, etc.) Too early for the news to kick in in unfavorable factors – although slow pays have started.

- Most established economies were already in distress – this put them over the edge.

Government Bail Out

- The $1200 check is not going to have much impact. It only offers 2 weeks of support.

- Expanded unemployment is a small help.

- The loans are the biggest factor. Keeping people working is key. Loans/grants contingent on keeping people on the payroll.

- There will be some provisions for airlines – the government will now have some ownership share of the companies. The idea is the later the government will be able to later sell the shares to recoup the investment.

- The sectors that have been most affected are related to retail, tourism, entertainment. Pharma and automotive have been doing fine – except where there is exposure from Asia.

- Companies related to the oil industry are being impacted. The Russians are working to destroy our oil sector amid this crisis.

- Las Vegas and Florida are hardest hit by the crisis because of tourism.

- Financial stress is now expanding. The real damage going forward is going to be financial. Supply chains – particularly for tech and electronics – are disrupted.

Future Look

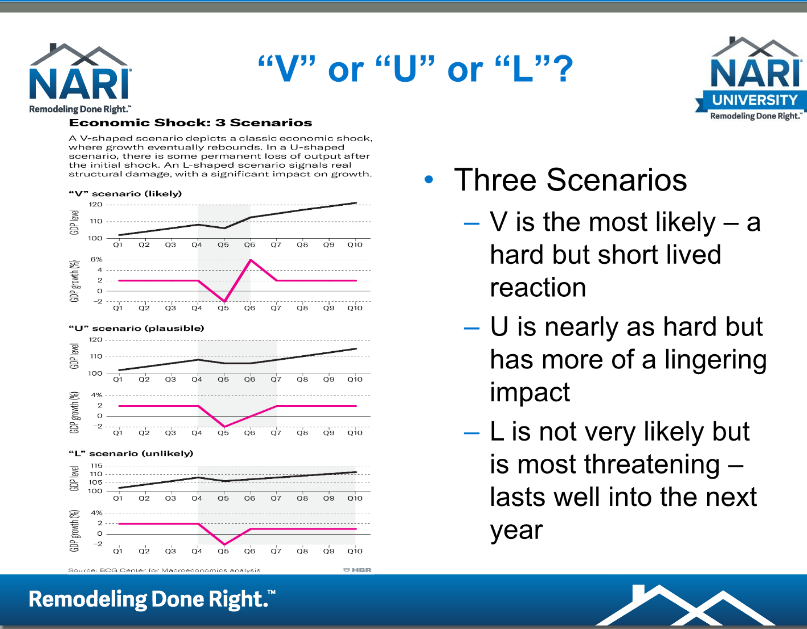

It is looking like the recovery is most likely going to be a “V” or “U” scenario. To help the recovery it will be important that consumers quickly return to normal. We also need continued investment by the government. Signs do not suggest that we will have the “L” scenario – it appears to be a less than 10% likelihood.

Overall, the conclusion is that the supports by the government and restrictions imposed should have the effect of quickly limiting the impact of the virus. This should allow for a quick return to normal and a rebound of the economic environment.

To see the full presentation Click Here.